If you are thinking about investing in single family rental properties then it is useful to have a tool that you can use to compare rents across different markets and cities in the U.S.

One of the easiest tools to use to analyze rental properties is called the “Gross Rental Yield”.

Although prices have increased since the 2010 lows, there are still many markets with very attractive rates of return on Single Family Rental Properties. A simple way to view these rates of return side by side in order to compare returns in different cities is by using the Gross Rental Yield.

Gross Rental Yield is the Gross Annual Rent of a rental property divided into the purchase price you would pay to buy that property.

For example if you purchased a house for $150,000, and the monthly rent on that house was $1,300 per month then the Gross Annual Rent would be $15,600. Your rate of return using the Gross Rental Yield would be 10.4%

Here’s the math:

$1300 month x 12 months = $15,600 Gross Annual Rent.

$15,600 Gross Annual Rent Divided By $150,000 Purchase Price = 10.4%.

Utilizing a tool like Gross Rental Yield is very useful since it allows you to compare the rental returns across different cities and states without taking any other factors like financing into account.

Financing or how you pay for the property is not part of the Gross Rental Yield Formula. Neither are expenses like property taxes, insurance, maintenance, repairs and vacancies. So the Gross Rental Yield Formula does not tell you what your net return on investment would be since you would still have financing costs, insurance, property taxes, repairs and maintenance to consider.

Gross Rental Yield is simply a quick tool that you can use to compare “gross rental yields” on single family homes.

A Single Family Rental Market Report published by the website RealtyTrac (published in the the 1st quarter of 2016) compared Gross Rental Yields in 448 U.S Counties on single family homes throughout the U.S.

You can see the report on the RealtyTrac website here

Average Gross Rental Yields in the U.S. for these 448 counties were 9.4%. However there are many cities that have much higher Annual Gross Rental Yields. The counties with the Highest Annual Gross Rental Yields are listed below.

Counties with the Highest Annual Gross Rental Yields

Counties with the Lowest Annual Gross Rental Yields

So if you are thinking about investing in rental properties then perhaps investing in the Bay Area Counties around San Francisco is not a great idea since prices are very high relative to rents meaning you won’t make much of a rental return. In fact you may even have a negative return after taking into account property taxes, insurance, maintenance, repairs and vacancies.

Other Good Tools To Utilize

There are still a lot of amazing deals out there. Just a few days ago one of my investors purchased a single family home in West Palm Beach for $67,000. This property is a rental property and has a tenant in place who is paying $1,200 per month in rent. The Gross Annual Rent on that property is $14,400. The Gross Rental Yield is a whopping return of 21.49%.

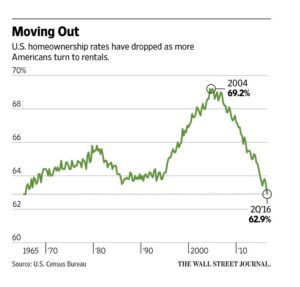

Many investors (including myself) are predicting that single family rental homes will increase substantially in price from current levels. Market rents will increase in price as well (market rents are already up 20% since 2012). With interest rates at record lows and the highest percentage of renters versus homeowners ever (see chart below) it’s harder to get approved for a mortgage – which means more renters and more demand for rental housing.

With interest rates at 30 year lows, and with the highest percentage of renters ever, there is a very compelling case for why it would be a good idea for you to invest in single family rental properties. You can still buy properties with gross rental yields of 20% or more like in the example of the West Palm Beach house returns above.

If you are financing, then I recommend that you finance your purchase with a 15 year mortgage. If you do that, then 15 years from now you will have a free and clear rental property which will be worth a lot more than it is today. And rents will be double what they are today resulting in a very substantial monthly income. One of my students has followed this advice and has purchased 5 rental homes in just the past 2 years. He obtained 15 year mortgages on all of the homes. 12 years from now he will own 5 houses free and clear and will have a net worth way north of a million dollars. And his monthly income will be equivalent to the income he receives today from his job. This is a very prudent retirement plan. Substantially better than investing in stocks, bonds or mutual funds.

The chart below shows the rate of U.S Home ownership since 1965 (when they first started tracking this data). As you can see we are currently at the lowest rate of home ownership ever. This means more renters than ever before. With interest rates at historic lows, high gross rental yields, and a lot more renters it is a great time to buy a single family rental property.