INVESTING IN SECTION 8 TURN KEY RENTALS

If you are interested in learning more about investing in Section 8 Rental Properties then the best way for me to show you how investing in section 8 rentals works is to show you a real life example using one of my rental properties.

The example with the property below is an example of a section 8 rental property that is located in a lower income neighborhood. Section 8 rentals can be located anywhere and do not have to be located in lower income areas (although many times they are). But I have section 8 rentals in nice class B neighborhoods too. The designation on whether a property is eligible for Section 8 is based on the tenant (not the property). Any landlord call offer their rental properties to Section 8 tenants. There are pro’s and con’s to this.

WHAT IS SECTION 8?

Section 8 is a government backed program by the United States Department of Housing and Urban Development (HUD). It allows lower income individuals to be eligible for housing choice vouchers which are administered by local Housing Authorities or Public Housing Agencies.

Section 8 tenants pay a portion of their rent and the Housing Authority pays the balance. In certain circumstances, the Housing Authority pays 100% of the rent. The housing subsidy is paid by the Housing Authority directly to the landlord (usually in the form of direct deposit but some housing authorities still mail checks).

The family then pays the difference between the actual rent charged by the landlord and the amount subsidized by the program. Section 8 will not accept a rental property into their program or allow a tenant with a housing voucher to rent a property without inspecting it.

When it comes to earning a good return on your investment, or creating positive cash flow, Section 8 Rentals is an area of real estate investing that is definitely worth investigating. There are some major advantages in having the government pay all or a portion of your tenant’s rent.

The current housing crisis is a good example of that. With so many tenants not being able to pay rent, all of our housing payments from the Housing Authority come in like clockwork. We are currently buying more Section 8 Rental Properties and if you know anyone that owns Section 8 Rentals who is looking to sell make sure you give them my contact information. I prefer to buy bulk portfolios of at least 10 single family homes or more if possible.

There are many myths in real estate investing. The one everyone likes to repeat like it’s some form of mantra is “location, location, location”.

Personally I believe in cash flow, cash flow, cash flow.

Maybe if you are in Manhattan location matters. But to me, how much rent I am receiving, and the amount of that rent relative to the expenses of the property and being able to service my existing debt is what I am most concerned about.

Because without that, you don’t survive long in the real estate rental business. I saw many of my friends and business associates learn this lesson the hard way in the Financial Crisis of 2008 to 2010. Cash flow is king. And cash is king. To survive you need both in spades. You can’t play long term if you don’t survive. Remember that.

Another myth that new real estate investors need to dispel is that the house needs to look “cute”. You can certainly invest in nice houses and there are many advantages to investing in “pretty” houses versus ugly houses.

But I see too many new investors that tend to gravitate towards the house that looks really cute and adorable. The problem is that cute and adorable doesn’t make you any money. Cash flow is what makes you money. And one of the best kept secrets in real estate investing is that Section 8 properties in lower income neighborhoods have crazy positive cash flow.

Why?

Because the prices of houses are low relative to the rents. Lower income neighborhoods have characteristics that scare away many investors which keeps prices and demand down. They are also much more difficult to manage which is what scares many investors away. and keeps supply up.

These neighborhoods have higher crime, more unemployment and lower incomes. Many people in these neighborhoods are living on government assistance. This means that the residents of these neighborhoods are not always assured of the same safeties that we take for granted every day because basic necessities like food and money are a scarce commodity and some of these people will resort to crime.

And this is what scares many real estate investors away.

However the investors that are brave enough or bold enough to figure out how to put systems in place to manage these types of properties are rewarded very well. I have been investing in these properties for 17 years (since 2003). The cash flow is huge on these properties. When prices are high (like they have been over the past year) investors will gravitate to the income producing opportunities of these cash flowing rental properties.

When investors cannot find returns, they tend to look for cash flowing rentals in lower income neighborhoods. That is why they tend to move the most very late in the real estate cycle – right towards the end.

CASE STUDY OF A SECTION 8 RENTAL PROPERTY

the pictures below are of a rental property that I have owned for about 4 years. I purchased this property for just $20,000 from another investor that wanted out of being a landlord. When I purchased the property it was vacant and a real mess inside. It looked like this:

I spent around $10,000 getting the property rent ready. I installed new Kitchen Cabinets, new counter tops, new carpets, used appliances and painted the inside and outside and fixed some issues on the roof. We also had to repair the A/C and electrical.

This is what the house looked like before the last tenant moved in a few months ago. We replaced the carpets but the kitchen and bathroom are still the same from 2016 when I first purchased the property. As you can see this house is definitely not “cute” in any way. It’s livable. And it’s rent able. Maybe you wouldn’t want to live there but it rents for $865 to someone who does.

Before you can rent to a Section 8 tenant, the house needs to pass what’s called a a “Section 8 inspection”. This means that everything needs to be working properly, the house needs to be secure and it needs to be safe. Once you pass inspection, you can rent to a Section 8 Tenant.

The best part about owning one of these Section 8 Rentals is that the government pays you the rent every month and deposits it directly into your bank account. Can you imagine what it is like being a landlord and not having to chase rental income from your tenants every month? That is one of the hardest aspects of being a landlord which is completely eliminated by renting to Section 8 tenants. In times like this current crisis that is even more beneficial.

Another feature I like about Section 8 is that the housing authority inspects all properties at least once per year. That means that if anything is wrong with the property (or the tenant) they will let you know about it. The property is much less likely to get abused or mistreated because of these annual inspections. One of the biggest mistakes I see landlords making is that they don’t inspect their rental properties on a routine basis. You need to inspect your rentals at least once every 6 months.

The advantage with Section 8 is that the tenants don’t want to lose their housing vouchers since they love having the free rent (or subsidized rent). In some cases Section 8 pays all of their rent. In other cases Section 8 pays only some of the rent.

Here are the pictures of the house before the last tenant moved in:

This property is rented for $850 per month which is a gross annual income of $10,200. On my purchase price of $30,000 (including repairs) that is a gross annual yield of 34% which is unheard of in single family real estate.

I have many rental properties like this that have gross yields that are north of 40%. How did I acquire properties like this? By marketing to motivated sellers and absentee landlords in these lower income neighborhoods.

One of my favorite lists is to cross reference out of State Absentee Landlords with vacant properties and code enforcement violations. What could be more disgruntled than an out of State landlord with a vacant property with no tenant, and an active code enforcement violation where he/she is accruing daily fines. That is the best type of motivated seller and that is who we like to buy houses from. We buy houses from people that have to sell, not people that want to sell.

That is how you buy a perfectly good rental property for just $20,000.

Tip: You won’t find these on the MLS. And your local real estate agent does not know how to find these either. We spend thousands of dollars a month marketing to find these types of properties. And when we find them, we often flip them to other investors for a profit. Most of our investors will gladly pay us a fee of $10,000 or more to get their hands on one of these properties since they cash flow so well.

They are literal cash cows. They are like a Golden Goose. Which would you rather have? A “nest egg” or a “Golden Goose”? Nest eggs get spent. You can outlive your nest egg meaning you may live longer than you anticipate and then your savings will be gone. I learned this in my 12 years as a financial advisor (before real estate). I saw too many older people that simply ran out of money. That is why I like real estate. Rents go up and values go up.

A “Golden Goose” lay eggs every month (rent) and you get to increase the rent every year. They also go increase in value over time and they beat inflation over time too. If you can borrow money today from a bank to buy a rental property at an interest rate that is less than the inflation rate then you are being paid by the bank to buy a rental property!

And the fact that you can get tax deductions for owning a rental property is icing on the cake! The deductions are huge – especially since the 2017 Act was passed allowing for greater depreciation deductions.

Single family rental properties are hands down the best investment out there. There is no other investment that can even come close. Be careful what you read online because all of those reports about stocks being better than real estate were written by who? You guessed it – Wall Street. The one thing they always forget to mention is you can invest in real estate with little or no money down! Try and tell your banker you want to put down 10% to buy a portfolio of stocks and he will laugh at you. But tell him you want to put down 10% to buy a rental property and he will give you a loan application to complete.

Single Family Rental Properties are about as close to a “Golden Goose” as you can get:

So let’s assume I was crazy and I wanted to sell you this rental property. I say this because selling will only create a tax bill for me so there is no real benefit to me selling.

So why would I sell? Because I am constantly buying more houses and I am confident I can find other houses at a price that is less than what I would sell this house to you for. After all that is what I do for a living. And I am very good at it. I am very confident I can find and buy houses from motivated sellers at a huge discount in this market (and any market).

This is called the velocity of money. I buy properties with other people’s money (private lenders). I force appreciation and create forced equity by buying beaten up boarded up vacant houses way below market. Then I fix them, clean them up, and make them rent ready. Then I refinance the original private lender loan with a conventional bank loan.

The strategy is called Buy, Repair, Rent, Refinance (BRRR).

Watch this video below to understand how the BRRR method works:

After you have refinanced the property you can hold it long term in your rental portfolio. That is what we do. We keep most of our properties, but we also sell many of our houses to real estate investors looking for a turn key investment property.

If you are my student, or a new investor that is just starting out then you may want me to sell you this property or another property at a discount. That makes sense. If you attended my real estate training program and I taught you how you should learn how to buy real estate at a discount to market value it makes sense that you would want to buy at a discount.

Just don’t assume that I will be the one selling to you at a discount. Because I never sell real estate at a discount. I buy at a discount and I sell at retail.

I will sell an asset that I own to you or anyone else for about the same amount (or a little less) than what I could get selling it on the MLS.

Why?

Because if I sell it to you directly, I don’t have to pay a real estate commission. So I can afford to shave 5% to 10% off the asking price. If the property is in a lower income neighborhood I might even sell the property for a bigger discount. But I certainly will not be giving it away. But what I can do is give you everything on a silver platter. I have done the hard part. I found the property, fixed it up, rented it out and manage it. If you want a piece of that return then I am happy to oblige you by selling you one of my rentals. I will even manage it for you if you want me to.

If you want to learn how to find properties at huge discount like I do then consider attending my real estate training program and sign up for the Wholesaling Real Estate Boot Camp which will give you an introduction to Wholesale Real estate and why people sell houses for less than what they are worth.

If you can learn how to find houses at a discount, then you can make a lot more money by buying more of these houses at larger discounts. You can create more equity faster, which in turn will increase your net worth and your wealth that much faster. If you learn how to do this by using borrowed money (like I do) and by not using any of your own capital, then you will be able to exponentially increase your net worth by millions of dollars.

BUYING A TURN KEY RENTAL

If I were to sell this rental property to you for $70,000, and you used a regular conventional 15 year fixed rate mortgage to finance your purchase, and you were going to have a property management company (like us) manage it for you this is what your numbers would look like:

PURCHASE PRICE

Your Purchase Price $70,000

Down Payment $20,000

Closing Costs $1,000

Total Cash Investment $21,000

CURRENT RENT

This property is currently rented at $850 per month. We have a 5% annual rent increase built into the lease (the tenant agrees to the rent being raised by 5% per year on every lease renewal).

EXPENSES OF OWNING THIS PROPERTY

Mortgage Payment $339 Per Month (15 year fixed at 2.75%)

Mortgage Insurance $33 Per Month

Property Taxes $39.33 Per Month

Property Insurance $75 Per Month

Property Management $85 Per Month

That adds up to a total expenses of $571.33

However it would be wise for you to save some money for vacancies and repairs so we will use the industry average of 5% for each and save that $85 per month for use later. Trust me you will have $850 in repairs during the year. When the sink or toilet gets clogged, or on routine maintenance calls like the AC not blowing cold, hot water not working etc.

Vacancies and Repairs Expense

Vacancies (5%) $42.50 Per month

Repairs (5%) $42.50 Per month

Total Expenses Including Vacancies and Repairs $656.33

POSITIVE CASH FLOW $193.67 Per Month

$850 in rent per month less $656.33 in expenses will leave you with just $193.67 in positive cash flow per month. That will be $2,324.04 per year. I suggest that you save this money and do not spend it since over time you will need to update the property.

EXPENSES OVER THE NEXT 30 YEARS

The average life of a roof is 30 years so if the roof costs $9,000 to replace, and you have to replace the roof every 30 years then divide that $9,000 over 360 months and that is $25 per month. If the roof was recently completed then you get lucky on that item.

The A/C system needs to be replaced every 15 years so if you assume that is an expense of $4,500 every 15 years ($9,000 over 30 years) that is another $25 per month. If the A/C was recently replaced you won’t have to worry about that for awhile.

Now you know why our first two questions we ask sellers are “when was the roof replaced and when was the A/C replaced”?

If you have a septic tank and drain field, that will cost you $4,500 every 15 years to redo the drain field which is another $25 per month. If you have city sewer you won’t need to worry about this expense. If you have well water, you will have an expense to maintain on that as well. A new system is around $1,500. If your well runs dry that could be thousands.

I calculate $75 per month for major improvements like AC, Roof, Septic Tank and Drain Field. If you have an issue with old cast iron pipes that are rotted out you could spend another $9,000 putting in new PVC Pipes. That is another $25 per month. And if you need to update the electric every 15 years at $4,500 that could be another $25 a month. So if you are a smart landlord you would save at least $125 a month for major improvements that you will need in the future. If you deduct that $125 from the positive cash flow of $193.67 then you will be left with just $68.67 per month in positive cash flow.

Assume this will get eaten up in additional vacancies or maintenance repairs and you will most likely break even on this property. You may even lose a little bit of money.

BREAKING EVEN ON A RENTAL PROPERTY

Why buy a rental property if you are going to break even?

Why do it?

Why invest in real estate?

This is by far, the biggest mistake that I see new real estate investors making. They believe all the BS that they see on late night infomercials about collecting cash flow and they think that they can just kick back and live off the cash flow from their rentals.

That will work eventually. But it will take time. And statistics tell us that most new real estate investors give up way before that ever happens. Most investors quit in the first 2 years! They find the hassle of dealing with tenants, vacancies, repairs and maintenance to be exhausting. And when they find out that they are barely making any money then they quit. And the reason that they quit is that they don’t have their long term vision in place.

In the beginning, as a landlord you will most likely just break even.

You may even lose money like I talk about in the video below:

Watch this video below from my YouTube Channel to see me talking about this concept on rental properties for new investors:

THE DIFFERENCE BETWEEN WHOLESALE & RETAIL REAL ESTATE

What most new real estate investors don’t understand is the difference between buying like I do (at a huge discount to market value) or buying retail with a mortgage (like this example on this rental). Short term they are not the same thing. But long term they are. Why? Because if you buy this property with a 15 year mortgage then 15 years from now you will own the property free and clear. If I owned the property or you owned the property it would be the same investment. The only difference would be the management. Think about that for a second. The difference between a rental property that works, and one that doesn’t boils down to the property management and who is managing it.

Don’t focus on making money now. That is the biggest mistake new real estate investors make. Focus on the lifetime cash flow, price appreciation, tax deductions, passive income and retirement benefits of buying a rental property like this. Did you know that you could buy a rental property like this in your IRA and have all of that income be tax free? You can. It’s called a self directed IRA and many of my students, investors and lenders have used this tool to amass millions of dollars of real estate.

Did you know that there is a Corona Virus Stimulus Bill that let’s you take up to $100,000 out of your 401 without incurring the 10% penalty? You could be using that money to buy your first rental property (which beats leaving it in the stock market).

THE VISION YOU NEED TO HAVE

This is the vision that I want you to think about every single day.

This is the vision that you need to have if you want to create wealth.

Focus on buying just one rental property.

Get a 15 year fixed rate mortgage on that property so you can own it free and clear in just 15 years.

Fix up the property, and rent it out (or buy a turn key property that is already rented with a tenant in place like in this example).

Then when you have done that, buy your second, third, and fourth rental properties.

Try to buy at least 2 houses per year.

Focus on single family homes only because they are easier to rent and easier to sell (if you want to).

Make sure you get 15 year fixed rate mortgages on all of your rental properties.

Interest rates are at the lowest ever in U.S history.

There is no guarantee that interest rates will stay this low.

Buy a rental property now while you can lock in these low rates and low payments for 15 years.

Let’s say you purchase just two houses per year.

This is very doable because many of my students like Andy in the video below have done this. Andy started working with me 5 years ago when he was 25. When we did this video in 2018 he owned 5 houses.

Today Andy owns 9 houses and he is only 30. So in 5 years he has purchased 9 houses. And prior to meeting me, Andy had never owned a single piece of real estate. So when I say it’s doable to buy 2 houses a year it really is! Many of my students have done it. My student Elmer has 5 million dollars in equity in rental properties. He started just 7 years ago.

I personally purchased over 3 million dollars of real estate in just 18 months without using any of my own money (all private lender money).

Today Andy is 30.

He has almost 1 million dollars in equity on his rental properties.

Check out the video below of myself and Andy standing in front of a Section 8 Rental Property that he purchased in 2018.

If you do what Andy did, then…..

After 5 years you would own 10 houses.

In year 15, the houses that you purchased first (houses number 1 and 2) would be paid off (since you had a 15 year fixed rate mortgage).

in year 16, the houses that you purchased in your second year (houses 3 and 4) would be paid off.

in year 17, the houses that you purchased in your third year (houses 5 and 6) would be paid off.

in year 18, the houses that you purchased in your fourth year (houses 7 and 8) would be paid off.

in year 19, the houses that you purchased in your fifth year (houses 9 and 10) would be paid off.

And when that happens?

You will be able to travel the world living in fancy hotels and eating at restaurants for every single meal for every day for the rest of your life.

And you will do this off of the rental income that is being deposited into your bank account every single month by your tenants.

What would your life be like if you had an extra $20,000 per month deposited into your checking account every month without having to do anything?

Now that is a VISION! That is what I want you to strive for!

What about the freedom that comes from knowing that you will never need to work again for the rest of your life!

That you will never need to have a job or a boss.

Or that you will be secure and your family will be secure. In times like this, that is more important than ever!

That is the vision that I want you to focus on. I want you to see it clearly.

Lawrence of Arabia had a quote that I love about vision and dreams. For many years I had this quote on the wall in front of my desk computer.

Here is the quote:

“All men (and women) dream: but not equally.

Those who dream by night in the dusty recesses of their minds wake up in the day to find it was vanity and just a dream.

But the dreamers of the day are dangerous men (and women), for they may act on their dreams with open eyes, to make them possible.”

And that is what I want you to do.

I want you to create that vision.

I want you to create that dream.

And then I want you to act on those dreams with your eyes wide open and make them happen!

That is what I want you to understand.

I don’t want you to focus on the short term, and how much you will cash flow this month or next month or this year (or next year).

Think long term. Think about your future. Think about your families future.

Real estate will make you a multi millionaire (if you can just buy real estate and hold it long term and wait for it to happen).

If you already have money, and you just want to earn a good return on your money, then you should speak to me about being a private lender. I have private lenders that have been with me since 2003. They have earned a monthly interest payment every single month for 17 years. they got their payments during the Financial crisis, and during every previous crisis and they are getting their payments now during the current crisis too.

Their principal is always intact. These are interest only mortgages. Many of my lenders live off the interest they receive every month. They pay their bills with the interest that I send them. And they get their money every single month with zero volatility like the stock market. And their principal is always there. Secured by a first mortgage and a note on a single family rental property that I own. Investing in single family rentals is the most secure investment that you can make – especially now with the stock market volatility and the uncertainty in the economy!

Here is an interesting example of why it pays to hold real estate for the long term. This is a true story from my handyman/contractor.

He told me last week when we were reviewing repairs on a rental: “Lex, rentals are too much headache. Tenants don’t take care of the houses. I owned two and I sold them a few years ago”.

We were talking about a tenant that was evicted and he was giving me a quote to get the house rent ready for the next tenant. That is how the conversation came up. I never even knew he owned rentals previously.

I asked him what he sold the two houses for.

His answer was he got around $60,000 for each of them a few years ago.

I pressed him for the addresses so that I could look them up (I was curious).

Those two properties that he sold are now worth $200,000 each.

If he had just held them he would be close to owning them free and clear.

And he gave up on $140,000 per house.

That is $280,000 in equity!

How long would it take him (or you) to save up $280,000?

That is more than a quarter million dollars!

And he is still working hard every day to make money to pay his bills.

Don’t do that.

Be smart.

You may live a lot longer than you think you will.

And either way 15 years go by fast. Before you know it that property could be free and clear. But you have to start doing something TODAY.

All he thought about was the short term hassle and the expenses of managing the rentals, instead of focusing on the long term potential of these two rental properties to make him wealthy.

The headache of owning rental properties is worth it!

And if you don’t want the headache then simply get a property manager.

RENT INCREASES

The most important thing to understand is that your payment is fixed, but rents go up every year. Most new investors do not understand this basic concept. For example we have a 5 year rent increase built into the lease on this rental and every one of our rentals. We do that on all of our rentals. If you are a smart landlord you would do that too. If a tenant moves out and does not renew we make sure that we are at or above prevailing rates. I see too many landlords with rentals that are below market because they are “scared” of losing their tenant. Don’t be that landlord.

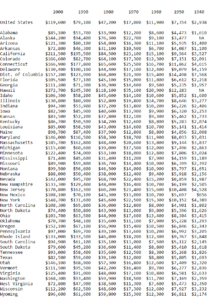

If we raised rents at just 5% per year on this $850 per month rental then this is what the rental rates would look like over time (click on the link below to see the PDF).

As you can see, after just 5 years of owning the property, rents would have increased to $1,084 and you would be positive cash flow by $428 per month which is $5,136 per year. You can take a family of 4 people to the Caribbean on a Cruise for 7 days every year with that $5,136 per year.

After 10 years of owning this rental property, rents would have increased to $1,384 per month, and your positive cash flow would now be $728 per month which is $8,736 per year.

After 15 years, you would own the property free and clear (no mortgage) and rents would be $1,767 per month. Since you now have no mortgage payment, your expenses would only be $284 per month. So you would now be putting $1,483 per month into your pocket which is a whopping $17,796 per year. And you would be doing that EVERY YEAR. That’s $177,796 per year if you had ten of these rental properties!

All of the above is just discussing the money created from increasing the rent. 5% in rent increases might sound like a lot to you but it is not! Case in point, this house you are looking at, I rented for just $600 about 4 years ago. If you do the math, increasing from $600 to $850 over 4 years is a lot more than 5% per year – it’s more like 10% per year! You can do that when you buy property cheap – which is why you need to learn how to buy properties at wholesale prices (not retail prices).

PRICE APPRECIATION

What about appreciation of the property?

If the property went up at just 4.8% per year, then it would double in value over 15 years. So if it was worth $70,000 today, then in 15 years it would be worth $140,000. Keep in mind that real estate in Florida has appreciated at substantially higher than 4.8% per year. It has appreciated at close to 8% for the past 50 years. But let’s be conservative and assume the property price only doubles in valuable and that prices only increase at 4.8% per year. Whenever I bring this up there is always someone who likes to point out about how real estate prices crash sometimes. Yes they do but this is a short term OPPORTUNITY for you to buy at a discount just like 2009 was.

Look at this long term chart by the U.S Housing Census showing the median price of a single family home since 1940. This chart illustrates why it pays to think long term. It also illustrates why it pays to pay attention to inflation. If you can borrow money from a bank at less than the inflation rate you are protected and your property will increase in value over time because of this inflation. But the bank will only get their payment. Which is why you should be very eager to borrow money from the bank to buy a single family home right now. I just got a 15 year mortgage at 2.75%.

EQUITY

Every month, your mortgage payment goes down by approximately $224.73. That’s because $224.73 of your $339 payment is principal. The rest is interest. So almost 70% of your payment is paying down the balance that you owe on the house. That means that if you owed $50,000 in the first month, you owe $49,775 in month 2 and you owe $49,500 in month two.

After just 4 months of mortgage payments you have already reduced the balance that you owe to the bank by $1,000. That is the best forced savings plan that there is and it forces you to save money. You are using your tenant’s rent money to pay down your mortgage, and every month your balance that you owe on the property is going down. I don’t know why they don’t teach this at school. It should be mandatory in our education system.

Take a look at the amortization schedule below that shows you how after just 20 months of making payments (less than 2 years) you have reduced your balance from $50,000 down to $45,406. Over time, the property goes up in value and the amount you owe goes down in value.

Your loan balance goes down every single year until you own the property free and clear. if you want to know how much equity you have at any time, simply take the current market value of the property, and deduct the outstanding balance on your mortgage and this is your equity in the property. The bank will give you a statement every month, that will show you your outstanding balance.

INVESTING IN TURN KEY RENTAL PROPERTIES

If you are interested in learning more about buying turn key rental properties like the example on this page then please use the button below to schedule an appointment with me. Please note that my time is very valuable, so I ask that if you book an appointment with me that you first send me proof that you have the cash available to invest in rental properties. If you are not willing to do this, I am not willing to take the time to have a conversation with you. I think that’s fair.

I can offer you property management on any of the properties that we manage included for 10% of the monthly rent amount. On this example that would be $85 per month on an $850 rental.

If you are looking for nicer properties in better areas then we have many of those as well. Here is an example of the type of Turn Key Rental Property in Port St Lucie, FL that is the most popular with our investors. This is a really nice house in a really good neighborhood.

Many of our investors (most) don’t like section 8 rentals and don’t want to invest in lower income neighborhoods (which is understandable). The decision is a personal one. Most of our investors want nice houses in good neighborhoods with good schools. They want to own these long term as investment properties.

The fact that our properties are all located in Florida is a bonus because some of our investors buy these investment properties in nice areas, so that they have a long term insurance policy on price increases if they ever choose to move to Florida in the future to retire. We also have investor’s that buy properties as vacation rentals and Airbnb vacation rentals in areas that are popular with tourists like Fort Lauderdale and Miami.

We sell hundreds of these homes to investors from all over the U.S (and we have many investors from all over the world including Israel, Brazil, China, Russia, Europe, South America etc.).

INVESTING IN SINGLE FAMILY RENTAL PROPERTIES

Investing in single family rental properties is hands down the best investment you can make – especially in today’s market! There really is nowhere else that will offer you this high return with this level of safety and security with such little risk. Investing in single family rentals is a way better investment than investing in a piece of paper like a stock, bond or mutual fund. That is my personal opinion. But it is an opinion based on 33 years of experience of investing including working on the Chicago Board of Trade, and being a stockbroker, financial advisor and money manager for 12 years (managing over 80 million dollars).

You can’t live in a stock, bond or mutual fund. But you can live in a house. and you can also rent a house to a tenant that will pay you rent every month. I prefer investing in hard assets like real estate. I like things that are tangible and that I can see and touch. I don’t like paper assets like stocks and bonds. Too rife with fraud and manipulation and you have to have seriously good inside intel to do well.

But with single family rentals, any intelligent person that has a job and decent credit can participate. At least that is true in the U.S where you can buy a house for as little as 3.5% down with an FHA mortgage.

You can buy a property to live in, or you can buy a property and rent it out to someone else to live in. And you can have the tenant (renter) pay your mortgage payment. Think about what a beautiful thing that is. They pay your mortgage, and you get the tax deduction. It doesn’t sound fair. It almost sounds like it can’t be legal. But it is. Not only is it legal but the government gives us incentives and tax deductions and depreciation expenses to buy rental properties. They want us to invest in real estate so that we will not be a burden on the social security system in the future. Is this not reason enough to want to own rental properties? And sadly, 1 out of 3 people does not own a home and still rents. And very few people that own a home also own a rental property. That is a mistake.

Investing in single family rentals is the easiest and surest way to create long term wealth (at least in the U.S). And if you don’t want to deal with owning rentals, the next best thing is to be the private lender and get a consistent monthly return backed by the real estate on single family rentals.

Either way, I highly encourage you to invest in single family rental properties. Real estate is a great inflation hedge. If we have inflation (we always have inflation) then real estate helps you to protect the long term value of your money and your savings. If we ever have hyper inflation then borrowing money at low rates and investing it in real estate will turn out to be the trade of the century. Some very smart people believe that this will happen.

DO NOT WAIT TO BUY REAL ESTATE

Don’t wait to buy real estate.

Instead, buy real estate and wait!

If you do you, I promise you that will thank me 15 years from now when you own the property free and clear! I get emails from students of mine from past boot camps all the time, thanking me for pushing them to invest in real estate and encouraging them to buy their first rental property.

The benefits of real estate come in the long term from holding on to the real estate that you purchase until you own it free and clear.

This creates passive income. and this is what I recommend that you do.

If you want to apply for our coaching program to learn how to get started investing in turn key single family rentals then use the button at the bottom of this page to book a call with one of our coaches.

Feel free to call our office anytime at (561) 948-2127 (office hours are Mon to Fri 9 a.m. to 5 p.m. EST) or send an email to our Support Desk at: supportdesk@lexrealestategroup.com.

If you would like to apply for our coaching program, please use the “apply for coaching” button at the top of this page and then after you have completed that schedule your strategy session with one of our coaches by using the booking link below: